How much do you pay a tax accountant to assess your fixed asset listing? Would you like to do it in NetSuite? It’s possible if you have the Fixed Assets Management (FAM) module. Here are your basic implementation steps and considerations.

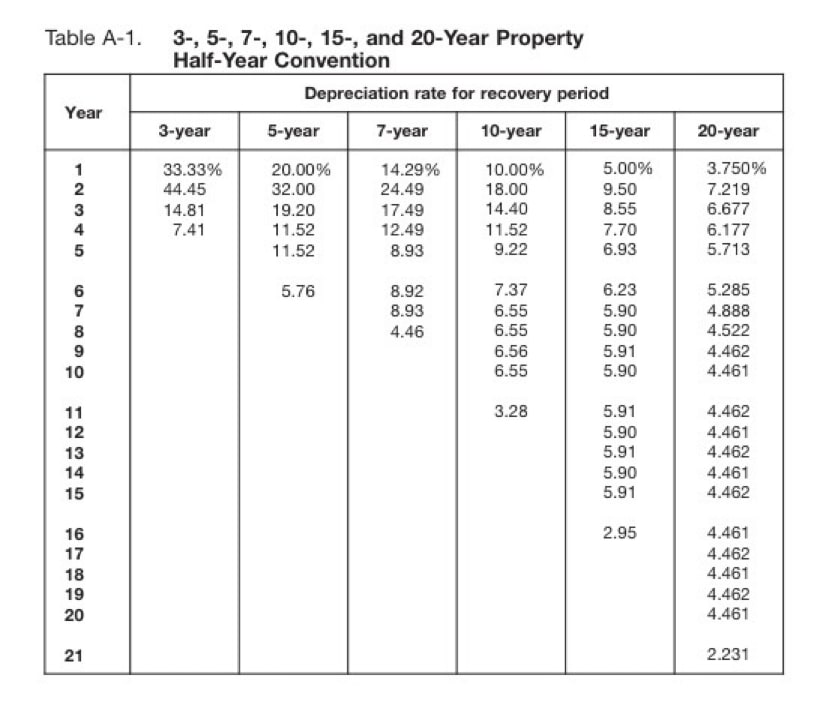

- Create an “Alternate Method” record for each unique combination of Lifetime, Depreciation Method & Convention. I recommend naming the alternate method after that combination (i.e., 5 yr 200DB MACRS HY).

- Decide on a Go Live date for the tax listing (typically based on the most recent tax filing). All asset balances will be migrated as of that date.

- Import “Alternate Depreciation” records via CSV. Record an external ID for the alternate depreciation record. Also, record the depreciable balance as the original cost (depreciable balance = cost less section 179 less bonus depreciation).

- Import DHR records as of the last day prior to Go Live date to record cumulative depreciation – these figures should tie out to your last tax filing. Use the external ID of the alternate depreciation record to tie the DHR to the alternate depreciation record.

- Go to Fixed Assets >> Setup >> System Setup and click “Precompute Depreciation Values.”

A couple other considerations:

- Several variables, such as convention, section 179 & bonus depreciation, vary based on capitalization patterns, gross revenue and tax policy. These may not be known until end of year. Thus, companies may not wish to create an alternate depreciation record until fully known.

- If company is reasonable confident in the outcome of these variables, the alternate depreciation records can be auto-generated from the asset type record (other methods subtab).