Avalara’s Guide to Sales Tax Automation

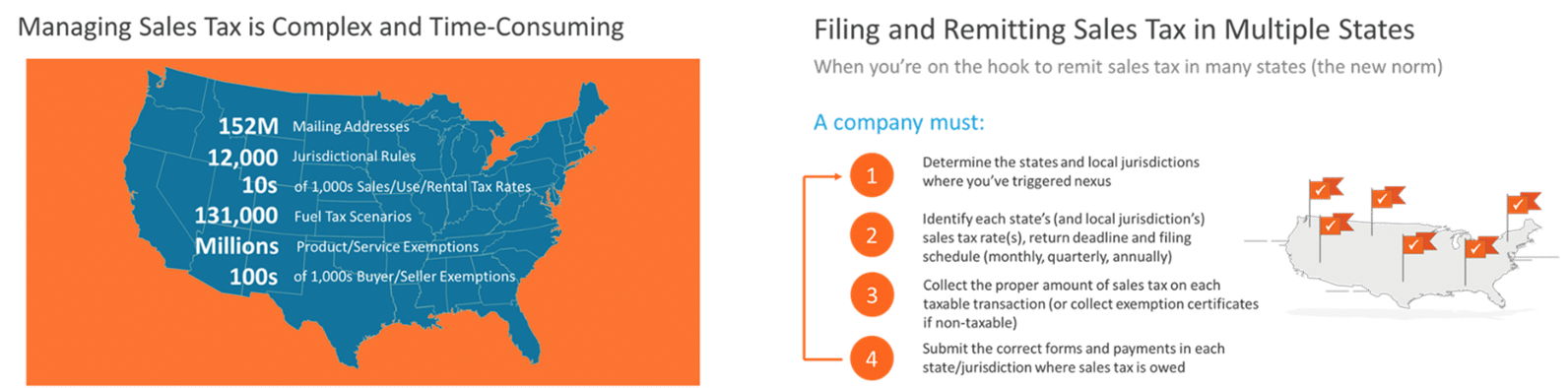

You must collect sales tax. Every state has different laws with different number of thresholds and with online sales, especially in the Covid era, a lot of people are purchasing online and remotely. Industries with the most compliance risk include retail, manufacturing and distribution, because they are directly selling to consumers and there are so many ways of selling and taxing software in the United States. Sales Automation is a process to improve efficiency and accurately to determine where your business has that requirement to collect sales tax and then manage your business registrations.

The 5 W’s of sales tax automation:

What is sales tax automation?

- Automate end-to-end sales tax processes for greater efficiency and improved accuracy

- Determine when/where your business has nexus

- Manage business registration

- Apply current tax rates according to jurisdiction

- Manage documents (exemption certificates)

- File and remit returns

- Cloud-based software tracks tax rates and laws and automatically update information

Who needs it?

- Almost all businesses can benefit from automation by saving time & resources

- Businesses in all industries can have sales tax obligations; not owing isn’t a get-out-of-filing-free card

- Must prove tax is not owed and file a standard sales tax return

- Each Business needs to evaluate ROI individually

- Single-location business that does not sell online vs.

- Multiple locations and sell into multiple states

Why automate?

- Accuracy: Real-time tax calculations

- Efficiency: Reduce costs and time spent managing tax compliance

- Risk Management: With accurate results, you will decrease your company’s risk

- Customer Satisfaction: Streamline transactions with instant sales tax calculations

- Business Growth: Free up resources to focus on high-value projects

When should you automate?

- Ahead of financial events (IPO, funding rounds, mergers & acquisitions)

- Pending company growth (launching new products, expansion, creating new divisions, etc.)

- Leadership and technology shifts (new CFO, new/updated technology platform)

- After a sales tax audit (*Hint: don’t wait that long!)

Why pursue automation now?

- In the midst of COVID-19, sales tax is the last thing businesses need to worry about. Automation reduces the burden.

- Sales tax rules change rapidly, especially in light of recent rate reductions and extensions

- States are experiencing significant losses in tax revenue and will likely look for ways to recoup those losses through increased audits, etc.

- Automation ensures businesses remain compliant through the chaos and reduce the risk of an audit

About Meridian Business, LLC

Meridian is an awarding winning NetSuite Solution Provider specializing in consulting, implementation, support, and development of the full range of NetSuite products. As a NetSuite partner, the mission of Meridian Business Services is to be an extension of our client’s advisory team to provide insight and advice to lay the foundation for the next phase of any business. Meridian has extensive experience delivering products and solutions to help clients make more effective business decisions in a wide array of industries. Visit www.meridianbusiness.com to learn more.

About Avalara, Inc.

Avalara helps businesses of all sizes get tax compliance right. We provide prebuilt integrations with Net Suite and other big-name financial and business management systems you trust. Avalara delivers cloud-based compliance solutions for transaction tax types, like sales and use, VAT, GST, excise, communications, lodging, and more. We’re headquartered in Seattle, with offices across the U.S. and in Canada, the U.K., Belgium, Brazil, and India. Get more information at www.avalara.com.