Financials Unlocked

Credit Best Practices

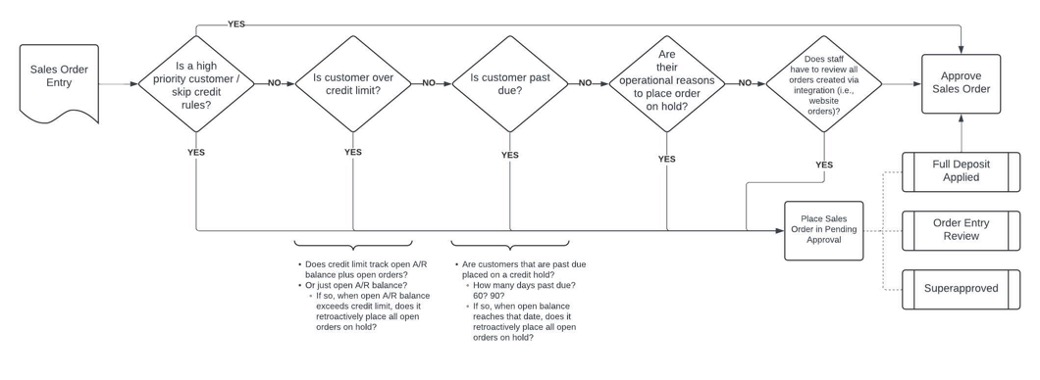

How does your credit team manage transactions in NetSuite? Here are my personal best practices:

- The credit team is responsible for maintaining terms and credit limit on customer records. Other roles should not have access to update these fields.

- Only the credit team has access to update terms on sales order/invoice. Other roles should not have access to update.

- May want the ability to have sales order rules applied to some customers over credit limit and not for other customers also over credit limit. If some segment of customers are priority and you want to retain credit information for tracking purposes, allow those customers to pass through the sales order workflow without getting pushed to “Pending Approval.”

- Sales orders are accepted as entered but will move to “Pending Approval” if customer is on a credit hold.

- NetSuite should display the reason(s) why a sales order is in “Pending Approval” state. This could be “Past Due”, “Over Credit Limit” or for operational reasons.

- Sales orders should be auto-approved if full deposit is made on the sales order (unless needing to be held for operational reasons).

- Credit manager should have access to “superapprove” a sales order if customer is over credit limit and special circumstance warrants approval.

- Customers should receive feedback on orders that are not initially approved. This can be from order entry staff or automated via email.